Sources of Funding to Community

Sources of Funding to Community

Sources of Funds

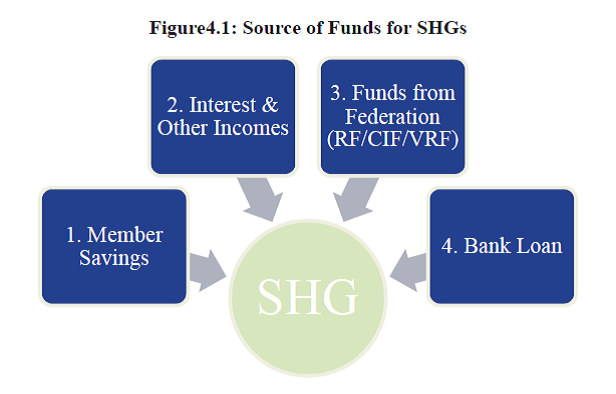

Self Help Groups have access to multiple sources of funds as depicted below. The SHGs need to be guided and prepared to access the Mission funds they are entitled to. More significantly, the SHGs need to be guided to accessing bank credit and other financial services on a continuous basis.

Facilitating the SHGs to access all potential sources of funds and to support and guide them to utilize the funds efficiently to improve, diversify and sustain their livelihoods is the critical role that the Mission units in general and the FI professionals in particular should play. This can be done in the following manner:

Gradual Augmentation of Member Savings

The savings rate (savings per member per meeting/per month) should be enhanced, taking into account the saving potential of the members; and

Introduction of new saving products like optional/ voluntary savings apart from regular savings. Savings may also be targeted for specific purposes and emerging needs of members such as education of children, construction of houses and for meeting health emergencies

Interest Income

Regular internal lending and recovery will contribute to higher income from interest charges If the SHGs undertake regular internal lending and recovery of loans, the interest income would exceed the total member savings in about 8 years; and

Funds from Federation

NRLM provides the following funds to capitalize the eligible community institutions of the poor and to enable them to access external sources of finance such as bank loans.

Revolving Fund (RF)

The Mission provides for a Revolving Fund of Rs.10000 to Rs.15, 000 per eligible SHG to catalyze the process of internal lending and to enable them to meet the immediate credit needs of the members.

Community Investment Fund (CIF)

The Mission also provides for Community Investment Fund as a resource in perpetuity to capitalize the institutions of the poor in three forms.

- Seed Capital to Cluster Level Federation (CLF) is for onward lending to SHGs via SHG Federation at the village level against SHG’s micro-investment/micro-credit plan.CIF equivalent to Rs 60,000 – Rs 1,10,000 per SHGs, is provided as a capital in perpetuity to each Cluster Level Federation (CLF).

- Vulnerability Reduction Fund to the village level primary federation of SHGs (Village Organization) for meeting the special needs of the vulnerable people on one hand and for addressing members’ different vulnerabilities like food insecurity, malnutrition, health risks, high cost debts and emergencies etc.

- Livelihoods/Layering Fund to the SHGs/SHG Federations and other collectives to support the deficit, if any, in the funding clear feasible and viable business plans.

Bank Loan

The funding support from the Mission is essentially intended to act as a catalyst for the SHGs to borrow larger amounts from the banks in a gradual manner such that in about 5 to 6 years, each SHG is able to access a credit amount of Rs.10.00 lakhs. The Master circular issued by RBI on 1st July, 2017 in this regard recommends the following amounts of loans:

Cash Credit Limit (CCL): In case of CCL, banks are advised to sanction minimum loan of Rs 6 lakhs to each eligible SHGs for a period of 3 years with a yearly drawing power (DP). The drawing power may be enhanced annually based on the repayment performance of the SHG. The drawing power may be calculated as follows:

- DP for First Year: 6 times of the existing corpus or minimum of Rs 1 lakh whichever is higher.

- DP for Second Year: 8 times of the corpus at the time review/ enhancement or minimum of Rs 2 lakh, whichever is higher

- DP for Third Year: Minimum of Rs 6 lakhs based on the Micro credit plan prepared by SHG and appraised by the Federations /Support agency and the previous credit History.

- DP for Fourth Year onwards: Above Rs 6 lakhs based on the Micro credit plan prepared by SHG and appraised by the Federations /Support agency and the previous credit History.

Term Loan: In case of Term Loan, banks are advised to sanction loan amount in doses as mentioned below:

- First Dose: 6 times of the existing corpus or minimum of Rs 1 lakh whichever is higher.

- Second Dose: 8 times of the existing corpus or minimum of Rs 2 lakh, whichever is higher

- Third Dose: Minimum of Rs 6 lakhs based on the Micro credit plan prepared by the SHGs and appraised by the Federations /Support agency and the previous credit History

- Fourth Dose: Above Rsd 6 lakhs based on the Micro credit plan prepared by the SHGs and appraised by the Federations /Support agency and the previous credit History Banks should take necessary measures to ensure that eligible SHG are provided with repeat loans.

Security and Margin:

- For loans to SHGs up to Rs 10.00 lakh, no collateral and no margin will be charged. No lien should be marked against savings bank account of SHGs and no deposits should be insisted upon while sanctioning loans.

- For loans to SHGs above Rs 10 lakh and up to Rs 20 lakh, no collateral should be charged and no lien should be marked against savings bank account of SHGs. However, the entire loan (irrespective of the loan outstanding, even if it subsequently goes below Rs 10 lakh) would be eligible for coverage under Credit Guarantee Fund for Micro Units (CGFMU).

Banks are advised to work with DAY-NRLM to institutionalize a mechanism for online submission of loan application of SHGs for tracking and timely disposal of application.

Source : National Rural Livelihoods Mission

Last Modified : 8/18/2021

This topic provides information about FAQs on *99#...

This topic provides information about Dollmakers.

This topic provides information about Leaving an I...

This topic provides information about Project Shak...