NCFE E-Learning Management System

NCFE E-Learning Management System

About NCFE

National Centre for Financial Education (NCFE) is a Section 8 (Not for Profit) Company promoted by Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), Insurance Regulatory and Development Authority of India (IRDAI) and Pension Fund Regulatory and Development Authority (PFRDA), under the aegis of Financial Stability and Development Council (FSDC), Ministry of Finance, Government of India.

Objective

- To promote financial education across India for all sections of the population as per the National Strategy for Financial Education of Financial Stability and Development Council.

- To create financial awareness and empowerment through financial education campaigns across the country for all sections of the population through seminars, workshops, conclaves, training, programmes, campaigns, discussion forums with/without fees by itself or with help of institutions, organisations and provide training in financial education and create financial education material in electronic or non-electronic formats, workbooks, worksheets, literature, pamphlets, booklets, flyers, technical aids and to prepare appropriate financial literature for target-based audience on financial markets and financial digital modes for improving financial literacy so as to improve their knowledge, understanding, skills and competence in finance.

Vision

A financially aware and empowered India.

Mission

To undertake massive financial education campaign to help people manage money more effectively to achieve financial well being by accessing appropriate financial products and services through regulated entities with fair and transparent machinery for consumer protection and grievance redressal.

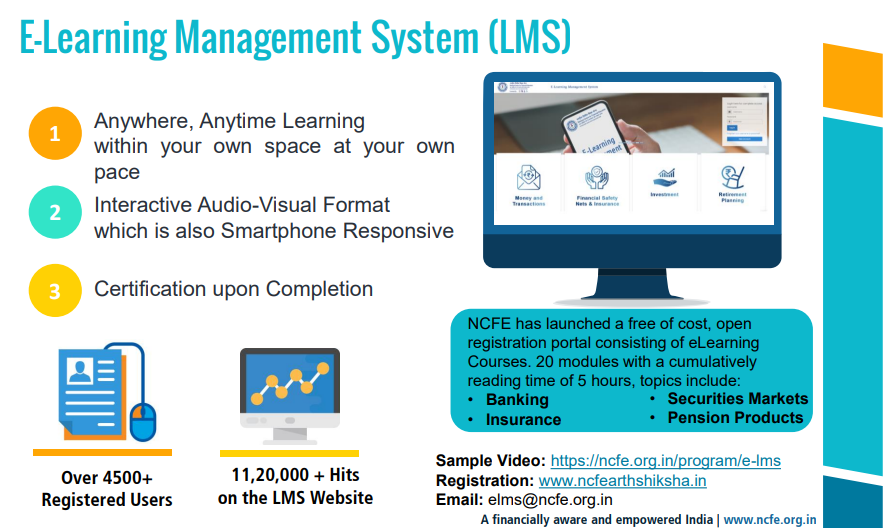

NCFE E-Learning Management System

NCFE has launched an e-learning course on basic financial education covering topics from Banking, Securities Markets, Insurance and Pension products. The topics are further subdivided into 20 modules like Money and Transactions, Financial Records and Contracts, Managing Income and Expenditure, Long Term Planning, Financial Safety Nets and Insurance, Scams and Frauds etc. The course is for 5 hours with each module of around 15-20 mins.

NCFE has launched an e-learning course on basic financial education covering topics from Banking, Securities Markets, Insurance and Pension products. The topics are further subdivided into 20 modules like Money and Transactions, Financial Records and Contracts, Managing Income and Expenditure, Long Term Planning, Financial Safety Nets and Insurance, Scams and Frauds etc. The course is for 5 hours with each module of around 15-20 mins.

The e-learning course is offered free of charge to all the registered users. This course will give users a solid knowledge base on disseminating financial literacy, which helps to address demand-side barriers as this makes customers informed and enables better financial decision making and ultimately financial wellbeing. The content of the course is being derived from the book Capacity Building for Financial Literacy Programmes (CABFLIP) primarily based on the Core Competencies on Financial Literacy document of OECD-INFE (International Network on Financial Education)

Course Registration

Any registered users can access the course and the registration is free of cost. The user must provide the authenticated e-mail ID and mobile number to complete the registration.

The user can register here at https://ncfearthashiksha.in and can access the course either by smartphone / PC. The course can also be accessed using mobile application by downloading the official Moodle aApp from iOS / Android Store.

Source: NCFE E-learning Course

Last Modified : 11/28/2023

Provides information about RBI Initiatives for Con...

This section covers aspects related to basics of f...

Provides information about the RBI Retail Direct S...

The topic covers details about various commonly us...