Understanding Long term goals in financial planning

Prakash, Rajendra and Leela’s old friend is now their informal financial advisor. He reminds them that setting long term goals is usually a greater challenge to plan for as compared to short term goals. This is due to a number of factors.

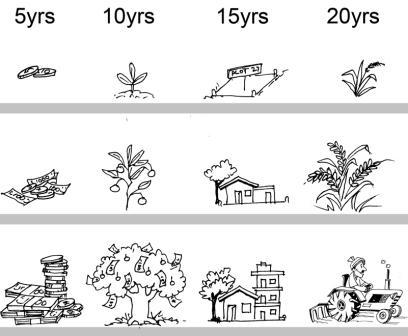

Firstly, long term goals are usually larger goals than the ones we plan for in the short term. For instance, in the short term, we plan holidays or decide to renovate a house or at best, buy a vehicle. In the long run, we plan for our children’s l education, marriage, our retirement, etc. As a result, long term goals usually require us to save up a large sum of money to meet them.

Secondly, we need to take into account the fact that over the long term, prices of everything rises. So, while we plan for a long term goal that costs Rs. 2 lakh today, it may well cost Rs. 4 lakh 15 years from today.

Lastly, planning for long term goals requires us to be ready for unexpected events which may require us to modify our plan. For instance, we may expect that our child will become a doctor or engineer. Accordingly, we begin planning and saving towards this goal 10 years in advance. However, our child may want to become an artist (which may involve a smaller financial investment) or study abroad (which may involve a greater financial investment).

Prakash concludes, “Understanding risk and inflation and planning for the same, help in achieving long term goals. Let me tell you about these two factors...”

Inflation

Prakash explains to them what inflation is and how it affects financial planning, especially planning for long term goals...

“Inflation is simply a term for rise in prices. It is measured using a formula that results in an index. An index records the average increase in the cost of things that you buy and services that you use. Most importantly, it gives you an idea of how much less you can buy with the same amount of money.

“Inflation is simply a term for rise in prices. It is measured using a formula that results in an index. An index records the average increase in the cost of things that you buy and services that you use. Most importantly, it gives you an idea of how much less you can buy with the same amount of money.

Let’s say, for simplicity sake, that you earn Rs. 100 in January 2010 and spend it at the super market to buy a specific number of items.

Now, if the prices of these items have risen by 7 per cent during the year, to buy the same things in January 2011 you will need Rs. 107. Alternatively, you will have to go without something that is now worth Rs. 7. So, your Rs. 100 is worth 7 per cent less than it was last year.

Here’s a real life example of how inflation eats into the value of your income – while Rs. 100 could buy you over 3 litres of petrol less than ten years ago, it could get you little over 2 litres of petrol in January 2008. Just 9 months later, in September 2008, you would have got about 1.85 litres of petrol for the same Rs. 100. And by October 2011, you can get merely 1.4 litres. What this means is that Rs. 100 has shrunk in value due to the rise in the price of petrol.”

“That’s interesting,” remarks Rajendra. “But how does it affect our financial planning?”

Prakash replies, “Let me tell you how with an example. My son is just 3 years old but I feel that he is really smart and will do a professional course from a premier institute when he grows up. Naturally, when he is ready for admission, I want to have the money handy.

I find out that the cost of a degree from a really good institute is Rs. 2 lakh at present. It’s another 17 years before he will be ready for the course and unfortunately, inflation makes everything more expensive. As I explained, an inflation rate of 5 per cent means that what cost Rs. 100 last year will cost Rs. 105 this year. Then, if inflation continues to remain at 5 per cent for the second year in a row, what cost Rs. 100 two years ago will not cost just Rs. 110.25, not just 110. This is because prices increase by 5 per cent over 105 in the second year.

So, let’s see how the value of the course will increase by the time my little boy is ready to do his degree. The figure of Rs. 2 lakh will become Rs. 2 lakh 10 thousand by the first year, assuming that inflation is at the rate of 5 per cent per annum. By the second year it will become Rs. 2,20,500. By the tenth year it will become Rs. 3,25,779. And, by the 17th year the cost of the course will be close to Rs. 4,60,000!”

“Now, I understand how inflation increases the cost of our long term goals. But what can we do to achieve our goals?” asks Rajendra.

“The figure may seem very large, but you do not have to worry. If you save as little as Rs. 1,000 per month and invest it in a financial product which gives you a return of 8% per annum (without withdrawing the interest that you receive on it), you will collect a sum of over Rs. 4,85,000 over the next 17 years,” explains Prakash.

“You make it sound so simple,” remarks Leela.

“This is only an example but the message is that no matter how large the amount seems, investing small amounts at regular intervals will help you collect that amount over a long period of time,” assures Prakash.

Risk

Prakash also explains to them what risk is and how it affects financial planning, especially planning for long term goals...

“When you hear the word ‘risk’ what do you think of?” asks Prakash.

“Danger!” replies Leela immediately.

“A lot of people do,” says Prakash. “But actually risk just means that we cannot say for sure how things will turn out. And yes, there is a chance that something undesirable could happen.”

“So when we say that long term goals face greater risks than short term goals, do we mean that with a long term goal we are unsure if our plan may or may not materialise?” asks Rajendra.

“Not really,” replies Prakash. “What it means is that the path to our goal may differ from what we expected it to be...but achieving our goal is totally in our hands.”

“I did not understand...” says Leela.

“Let me explain. Suppose you’ve started collecting money for little Preeti’s education and have started investing that money in equity mutual funds because they make your money grow over the long term. As per your financial plan, you plan to withdraw the money from the mutual fund when she is 20 years old and use it for whatever course she decides to do. However, two years before you need the money, you realise that the stock market is likely to fall and remain dull for a while. At the same time, bank fixed deposits are offering a good rate of interest. So, you may withdraw the money from the mutual funds and invest it in a bank fixed deposit so that it does not decrease in value. This is what I mean by the path to our long term goal being unpredictable.”

“And what do they mean when they call a financial product risky?” asks Rajendra.

Prakash replies, “In finance, risk means that we can’t say for sure what the value of a product and its returns will be at the end of the investment term. When we say something is ‘high risk’ it means that the final value is more unpredictable. And when we say ‘low risk’ it means that to a large extent we know how it will turn out. That is why we say that shares are high risk products and fixed deposits are low risk products.”

“So why should we invest in high risk products if it brings uncertainty?” asks Rajendra.

“One strange thing about risk is that the higher the risk you are ready to take while investing, the greater the chance of getting a high return. But remember, since it is a high risk, it means that you may get a high return or a terribly low return or a very average return, we can’t say for sure. With a low risk investment, you will know what return to expect and mostly you will get it. You can also be sure that it will not be as attractive as the return that can be expected from a high risk investment,” replies Prakash.

“So which is better - investments with high risk or low risk?” asks Leela.

“There is no single answer. It depends to a large extent on your personality and your circumstances. Some people are naturally ready to take risk – in fact they enjoy taking risks. Others may prefer getting lower returns as long as they are sure of how much they will get. It also depends on your circumstances. For instance, as you grow older and are approaching retirement, you feel less like taking risks. Also if you have to take care of a larger family, you may take less risk. And so on. It all depends on you!”

“Prakash, coming back to our discussion about risk and planning for long term goals, how can we protect ourselves from risk?”

“Insurance takes care of a lot of economic risks. For instance, in the event of an untimely death of the main earning member of a family, insurance provides the family with funds to carry on meeting goals, to some extent. Other types of insurance – auto insurance, crop insurance, home insurance, health insurance, etc. – compensate you economically for other unpredictable events such as accidents, illnesses, natural and man-made disasters...”

“So will buying insurance take care of the risk aspect of long term planning?” asks Leela.

“I am coming to that...there are other risks too. For instance, your goals may change or the priority of your goals may change. Then, your investments may not give you the return that you expect. In such situations, reviewing your financial plan regularly will help you to overcome such risks and achieve your goals.”

Source: Portal Content Team

Last Modified : 2/21/2020

This topic provides information on what one needs ...

This topic provides information about frequently ...