Digital Payments Enablers

Digital Payments Enablers

Reserve Bank of India (RBI) has always been the primary enabler of digital payments in India. From conceptualisation to execution, investment in knowledge and technology for payment systems involving large scale capital expenditure {MICR, CTS, ECS, large value payments (RTGS), retail payments (NEFT), etc.}, RBI has donned many hats, that of owner, operator, catalyst, regulator, et al.

India has followed the "bank-led" model with banks at the fore-front of payment systems operations, as it was felt that being adequately regulated, banks were better placed to take the payment systems forward. The approach has been to involve banks where float is involved, while non-banks can participate with fee as their income source. Easy access, swift absorption / adoption of new technology and innovation, quality of infrastructure, etc., are crucial elements for ensuring safe and quick payments which help in building confidence in the payment systems. The dual model followed in India combined the "trust" that the banks offered with the innovations of non-banks to upscale digital payments.

Mobile Phones and Internet

The growth of infrastructure in India has been phenomenal over the past decade, most notably in the spread of mobile cellular network. The increasing mobile density and mobile internet users are being leveraged upon by payment systems providers, both banks and non-banks, to offer payment services which is accessible over mobile and internet.

Along with internet banking, banks have been offering mobile banking services through all three channels - short message service (SMS), Unstructured Supplementary Services Data (USSD) and mobile applications.

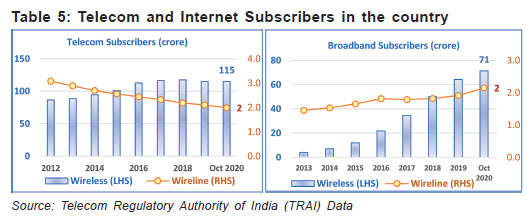

As at end of October 2020, India had over 115.1 crore wireless telephone subscribers resulting in a tele-density of 84.90%. The urban tele-density and rural tele-density was 136.65% and 58.72%, respectively, which is growing. Increase in smartphone usage has also helped accelerate the adoption of digital payments. Further, it has led to numerous innovations in payment mechanisms, such as tokenisation and scanning of Quick Response (QR) code for making payments using smartphones.

Internet usage is on the rise in India. While the average Indian, until 2013, spent more on voice services than on mobile data services, a significant share of an average mobile bill now pertains to data charges according to a report by the Internet and Mobile Association of India (IAMAI). As at the end of October 2020, there were over 71.3 crore and 2.1 crore wireless and wireline broadband subscribers, respectively. The increase in internet penetration has facilitated and also accelerated the adoption of digital modes of payments. With rapidly increasing penetration of 3G and 4G, even in remote areas, India is witnessing a ';Digital Revolution'; which is surely but steadily evolving into a ';Digital Payments Revolution.'; Recent evidence indicates that Indians consume on an average about 10 GB data every month.

Bank Accounts

The number of deposit accounts has grown to 235 crore as at end March 2020. These include deposit accounts in all commercial banks including Local Area Banks (LABs), PBs, SFBs, RRBs and Cooperative Banks in the country. The availability of bank accounts played a key role in initiating digital payments from / to such accounts.

Aadhaar

Since its launch in 2009, Aadhaar, a unique identification number has been issued to over 127 crore individuals across the country. ';Aadhaar'; enabled e-KYC (electronic-Know Your Customer) has resulted in an exponential growth of digital payments in India. The use of Aadhaar has also been leveraged for authenticating payments to merchants as well as transactions made through Business Correspondents (BCs). The coverage of Aadhaar biometric identification has witnessed increased use in Government to Person (G2P) payments and has helped reduce leakages from the system by expunging fake beneficiaries. These payment systems have helped migrate cash payments to electronic form.4 Aadhaar has been subject to many a legal tussle and its acceptance and use in payments has seen a see-saw battle over the years. Ironically though, many other jurisdictions see Aadhaar as a successful experiment. Availability of biometric identification (fingerprints) with face and iris scans can be leveraged to push digital payments to exponential levels, of course privacy and other concerns have to be given due consideration.

Debit and Credit Cards

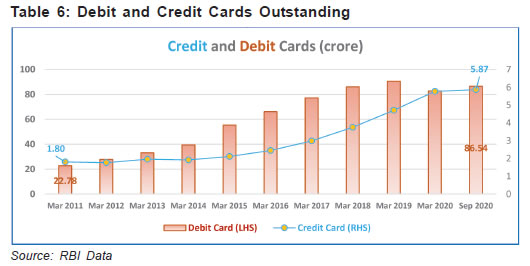

In India, credit cards are considered taboo and viewed more as products for the elite. Over the past 10 years, during the period between FY 2010-11 and FY 2019-20, the number of debit cards issued increased from 22.78 crore to 82.86 crore, of which around 30 crore comprised of RuPay debit cards issued to Basic Savings Bank Deposit (BSBD) account holders. During the same period, the number of credit cards issued also increased from 1.80 crore to 5.77 crore. Increase in cards has facilitated growth in both online and physical PoS terminal based card payments resulting in an increase in digital transactions.

Banks issued new cards to comply with the requirement to convert all existing Magstripe cards to Europay Master Visa (EMV) Chip and Personal Identification Number (PIN) compliant cards by December 31, 2018 and subsequently removed deactivated cards from their systems, resulting in a reduction of debit cards outstanding in the FY 2019-20. The consolidation of public sector banks also contributed to this reduction.

Source : RBI

Last Modified : 9/17/2023

This topic provides information related to soiled ...

This topic provides information about Mobile Aided...

RBI's FAQs on Cash Withdrawal Facility at Point of...

This topic provides information about Frequently A...